PANDAS技術分析( Pandas TA )是一個易於使用的庫,它利用PANDAS包具有130多個指標和實用程序功能以及60多個TA Lib Candlestick模式。包括許多常用指標,例如:蠟燭圖案( CDL_PARTTEN ),簡單移動平均( SMA )移動平均平均收斂差異( MACD ),船體指數移動平均平均值( HMA ), Bollinger帶( BBANDS ),平衡量( OBB) ) , Aroon&Aroon振盪器( Aroon ),擠壓(擠壓)等。

注意:必須安裝ta lib才能使用所有燭台圖案。 pip install TA-Lib 。如果未安裝ta lib ,則只有內置的燭台圖案可用。

talib=False禁用每個指示器禁用。ta.stdev(df["close"], length=30, talib=False) 。/pandas_ta/custom.py下的import_dir文檔。ta.tsignals方法進行回歸。lookahead=False to disable。Pandas ta檢查用戶是否安裝了一些常見的交易軟件包,包括但不限於: ta lib , vector bt , yfinance ...其中大部分是實驗性的,並且可能會破裂,直到它穩定更多為止。

help(ta.ticker)和help(ta.yf)和下面的示例。pip版本是最後一個穩定版本。版本: 0.3.14b

$ pip install pandas_ta最佳選擇!版本: 0.3.14b

$ pip install -U git+https://github.com/twopirllc/pandas-ta這是可能具有錯誤和其他不希望的副作用的開發版本。自身使用!

$ pip install -U git+https://github.com/twopirllc/pandas-ta.git@development import pandas as pd

import pandas_ta as ta

df = pd . DataFrame () # Empty DataFrame

# Load data

df = pd . read_csv ( "path/to/symbol.csv" , sep = "," )

# OR if you have yfinance installed

df = df . ta . ticker ( "aapl" )

# VWAP requires the DataFrame index to be a DatetimeIndex.

# Replace "datetime" with the appropriate column from your DataFrame

df . set_index ( pd . DatetimeIndex ( df [ "datetime" ]), inplace = True )

# Calculate Returns and append to the df DataFrame

df . ta . log_return ( cumulative = True , append = True )

df . ta . percent_return ( cumulative = True , append = True )

# New Columns with results

df . columns

# Take a peek

df . tail ()

# vv Continue Post Processing vv一些指標參數已被重新排序以保持一致性。使用help(ta.indicator_name)以獲取更多信息或提出拉動請求以改進文檔。

import pandas as pd

import pandas_ta as ta

# Create a DataFrame so 'ta' can be used.

df = pd . DataFrame ()

# Help about this, 'ta', extension

help ( df . ta )

# List of all indicators

df . ta . indicators ()

# Help about an indicator such as bbands

help ( ta . bbands )感謝您使用Pandas TA !

$ pip install -U git+https://github.com/twopirllc/pandas-ta謝謝您的貢獻!

Pandas TA有三個主要的“樣式”處理用於您的用例和/或要求的技術指標。它們是:標準,數據幀擴展和熊貓TA策略。每種都有越來越多的抽像水平以易於使用。隨著您對大熊貓TA的熟悉,使用Pandas TA策略的簡單性和速度可能會變得更加明顯。此外,您可以通過鏈接或組成創建自己的指標。最後,每個指示器要么返回大寫下的系列或數據框,無論樣式如何。

您明確定義輸入列並照顧輸出。

sma10 = ta.sma(df["Close"], length=10)SMA_10的系列donchiandf = ta.donchian(df["HIGH"], df["low"], lower_length=10, upper_length=15)DC_10_15和列名稱的數據框: DCL_10_15, DCM_10_15, DCU_10_15ema10_ohlc4 = ta.ema(ta.ohlc4(df["Open"], df["High"], df["Low"], df["Close"]), length=10)EMA_10的系列。如果需要,您可能需要唯一的命名。呼叫df.ta將自動將OHLCVA較小為OHLCVA :開放,高,低,關閉,音量, adj_close 。默認情況下, df.ta將使用OHLCVA進行指示參數,以刪除直接指定輸入列的需要。

sma10 = df.ta.sma(length=10)SMA_10的系列ema10_ohlc4 = df.ta.ema(close=df.ta.ohlc4(), length=10, suffix="OHLC4")EMA_10_OHLC4close=df.ta.ohlc4() 。donchiandf = df.ta.donchian(lower_length=10, upper_length=15)DC_10_15和列名稱的數據框: DCL_10_15, DCM_10_15, DCU_10_15與最後三個示例相同,但將結果直接附加到DataFrame df上。

df.ta.sma(length=10, append=True)df列名稱: SMA_10 。df.ta.ema(close=df.ta.ohlc4(append=True), length=10, suffix="OHLC4", append=True)close=df.ta.ohlc4() 。df.ta.donchian(lower_length=10, upper_length=15, append=True)df : DCL_10_15, DCM_10_15, DCU_10_15 。熊貓策略是由策略方法運行的一組指標。所有策略都使用MulitProcessing,除非使用col_names參數(見下文)。下一節中列出了不同類型的策略。

# (1) Create the Strategy

MyStrategy = ta . Strategy (

name = "DCSMA10" ,

ta = [

{ "kind" : "ohlc4" },

{ "kind" : "sma" , "length" : 10 },

{ "kind" : "donchian" , "lower_length" : 10 , "upper_length" : 15 },

{ "kind" : "ema" , "close" : "OHLC4" , "length" : 10 , "suffix" : "OHLC4" },

]

)

# (2) Run the Strategy

df . ta . strategy ( MyStrategy , ** kwargs )策略類是一種使用數據類命名和分組您喜歡的TA指標的簡單方法。 Pandas Ta提供了兩種預先建立的基本策略,可以幫助您入門: Allstrategy和Commandate 。策略可以像使用組成/鏈接一樣簡單,也可以根據需要盡可能複雜。

df上。有關指標組成/鏈接在內的示例,請參見pandas ta策略示例筆記本。

{"kind": "indicator name"}屬性,則在Pandas TA消耗時,策略將失敗。切記檢查您的拼寫。 # Running the Builtin CommonStrategy as mentioned above

df . ta . strategy ( ta . CommonStrategy )

# The Default Strategy is the ta.AllStrategy. The following are equivalent:

df . ta . strategy ()

df . ta . strategy ( "All" )

df . ta . strategy ( ta . AllStrategy ) # List of indicator categories

df . ta . categories

# Running a Categorical Strategy only requires the Category name

df . ta . strategy ( "Momentum" ) # Default values for all Momentum indicators

df . ta . strategy ( "overlap" , length = 42 ) # Override all Overlap 'length' attributes # Create your own Custom Strategy

CustomStrategy = ta . Strategy (

name = "Momo and Volatility" ,

description = "SMA 50,200, BBANDS, RSI, MACD and Volume SMA 20" ,

ta = [

{ "kind" : "sma" , "length" : 50 },

{ "kind" : "sma" , "length" : 200 },

{ "kind" : "bbands" , "length" : 20 },

{ "kind" : "rsi" },

{ "kind" : "macd" , "fast" : 8 , "slow" : 21 },

{ "kind" : "sma" , "close" : "volume" , "length" : 20 , "prefix" : "VOLUME" },

]

)

# To run your "Custom Strategy"

df . ta . strategy ( CustomStrategy )Pandas TA策略方法利用多處理來進行所有策略類型的批量處理,但一個例外!當使用col_names參數重命名結果列時, ta數組中的指示器將按順序運行。

# VWAP requires the DataFrame index to be a DatetimeIndex.

# * Replace "datetime" with the appropriate column from your DataFrame

df . set_index ( pd . DatetimeIndex ( df [ "datetime" ]), inplace = True )

# Runs and appends all indicators to the current DataFrame by default

# The resultant DataFrame will be large.

df . ta . strategy ()

# Or the string "all"

df . ta . strategy ( "all" )

# Or the ta.AllStrategy

df . ta . strategy ( ta . AllStrategy )

# Use verbose if you want to make sure it is running.

df . ta . strategy ( verbose = True )

# Use timed if you want to see how long it takes to run.

df . ta . strategy ( timed = True )

# Choose the number of cores to use. Default is all available cores.

# For no multiprocessing, set this value to 0.

df . ta . cores = 4

# Maybe you do not want certain indicators.

# Just exclude (a list of) them.

df . ta . strategy ( exclude = [ "bop" , "mom" , "percent_return" , "wcp" , "pvi" ], verbose = True )

# Perhaps you want to use different values for indicators.

# This will run ALL indicators that have fast or slow as parameters.

# Check your results and exclude as necessary.

df . ta . strategy ( fast = 10 , slow = 50 , verbose = True )

# Sanity check. Make sure all the columns are there

df . columns 請記住,這些不會利用多處理

NonMPStrategy = ta . Strategy (

name = "EMAs, BBs, and MACD" ,

description = "Non Multiprocessing Strategy by rename Columns" ,

ta = [

{ "kind" : "ema" , "length" : 8 },

{ "kind" : "ema" , "length" : 21 },

{ "kind" : "bbands" , "length" : 20 , "col_names" : ( "BBL" , "BBM" , "BBU" )},

{ "kind" : "macd" , "fast" : 8 , "slow" : 21 , "col_names" : ( "MACD" , "MACD_H" , "MACD_S" )}

]

)

# Run it

df . ta . strategy ( NonMPStrategy ) # Set ta to default to an adjusted column, 'adj_close', overriding default 'close'.

df . ta . adjusted = "adj_close"

df . ta . sma ( length = 10 , append = True )

# To reset back to 'close', set adjusted back to None.

df . ta . adjusted = None # List of Pandas TA categories.

df . ta . categories # Set the number of cores to use for strategy multiprocessing

# Defaults to the number of cpus you have.

df . ta . cores = 4

# Set the number of cores to 0 for no multiprocessing.

df . ta . cores = 0

# Returns the number of cores you set or your default number of cpus.

df . ta . cores # The 'datetime_ordered' property returns True if the DataFrame

# index is of Pandas datetime64 and df.index[0] < df.index[-1].

# Otherwise it returns False.

df . ta . datetime_ordered # Sets the Exchange to use when calculating the last_run property. Default: "NYSE"

df . ta . exchange

# Set the Exchange to use.

# Available Exchanges: "ASX", "BMF", "DIFX", "FWB", "HKE", "JSE", "LSE", "NSE", "NYSE", "NZSX", "RTS", "SGX", "SSE", "TSE", "TSX"

df . ta . exchange = "LSE" # Returns the time Pandas TA was last run as a string.

df . ta . last_run # The 'reverse' is a helper property that returns the DataFrame

# in reverse order.

df . ta . reverse # Applying a prefix to the name of an indicator.

prehl2 = df . ta . hl2 ( prefix = "pre" )

print ( prehl2 . name ) # "pre_HL2"

# Applying a suffix to the name of an indicator.

endhl2 = df . ta . hl2 ( suffix = "post" )

print ( endhl2 . name ) # "HL2_post"

# Applying a prefix and suffix to the name of an indicator.

bothhl2 = df . ta . hl2 ( prefix = "pre" , suffix = "post" )

print ( bothhl2 . name ) # "pre_HL2_post" # Returns the time range of the DataFrame as a float.

# By default, it returns the time in "years"

df . ta . time_range

# Available time_ranges include: "years", "months", "weeks", "days", "hours", "minutes". "seconds"

df . ta . time_range = "days"

df . ta . time_range # prints DataFrame time in "days" as float # Sets the DataFrame index to UTC format.

df . ta . to_utc import numpy as np

# Add constant '1' to the DataFrame

df . ta . constants ( True , [ 1 ])

# Remove constant '1' to the DataFrame

df . ta . constants ( False , [ 1 ])

# Adding constants for charting

import numpy as np

chart_lines = np . append ( np . arange ( - 4 , 5 , 1 ), np . arange ( - 100 , 110 , 10 ))

df . ta . constants ( True , chart_lines )

# Removing some constants from the DataFrame

df . ta . constants ( False , np . array ([ - 60 , - 40 , 40 , 60 ])) # Prints the indicators and utility functions

df . ta . indicators ()

# Returns a list of indicators and utility functions

ind_list = df . ta . indicators ( as_list = True )

# Prints the indicators and utility functions that are not in the excluded list

df . ta . indicators ( exclude = [ "cg" , "pgo" , "ui" ])

# Returns a list of the indicators and utility functions that are not in the excluded list

smaller_list = df . ta . indicators ( exclude = [ "cg" , "pgo" , "ui" ], as_list = True ) # Download Chart history using yfinance. (pip install yfinance) https://github.com/ranaroussi/yfinance

# It uses the same keyword arguments as yfinance (excluding start and end)

df = df . ta . ticker ( "aapl" ) # Default ticker is "SPY"

# Period is used instead of start/end

# Valid periods: 1d,5d,1mo,3mo,6mo,1y,2y,5y,10y,ytd,max

# Default: "max"

df = df . ta . ticker ( "aapl" , period = "1y" ) # Gets this past year

# History by Interval by interval (including intraday if period < 60 days)

# Valid intervals: 1m,2m,5m,15m,30m,60m,90m,1h,1d,5d,1wk,1mo,3mo

# Default: "1d"

df = df . ta . ticker ( "aapl" , period = "1y" , interval = "1wk" ) # Gets this past year in weeks

df = df . ta . ticker ( "aapl" , period = "1mo" , interval = "1h" ) # Gets this past month in hours

# BUT WAIT!! THERE'S MORE!!

help ( ta . yf )不大膽的模式,需要安裝ta-lib: pip install TA-Lib

# Get all candle patterns (This is the default behaviour)

df = df . ta . cdl_pattern ( name = "all" )

# Get only one pattern

df = df . ta . cdl_pattern ( name = "doji" )

# Get some patterns

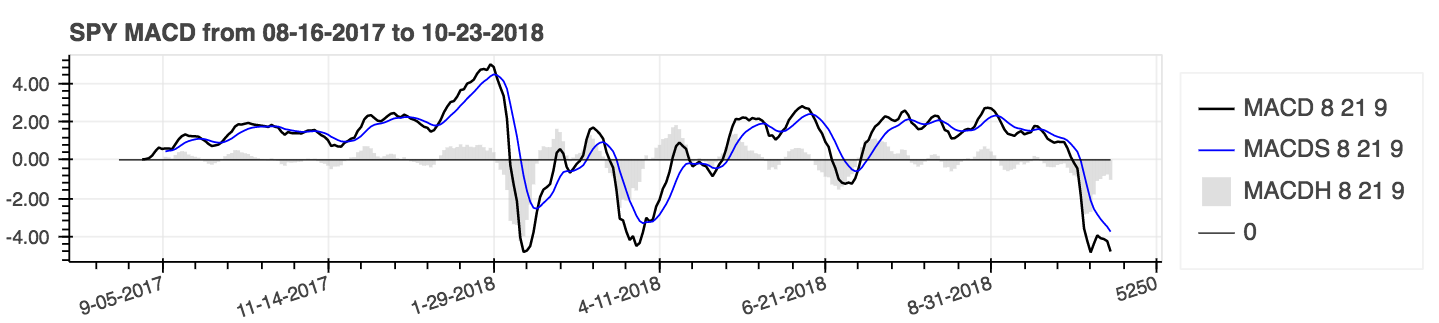

df = df . ta . cdl_pattern ( name = [ "doji" , "inside" ])ta.linreg(series, r=True)lazybear=Truedf.ta.strategy() 。| 移動平均收斂差異(MACD) |

|---|

|

help(ta.ichimoku) 。lookahead=False drops chikou跨度列,以防止潛在的數據洩漏。| 簡單的移動平均值(SMA)和布林樂隊(Bands) |

|---|

|

使用參數:累積=為累積結果。

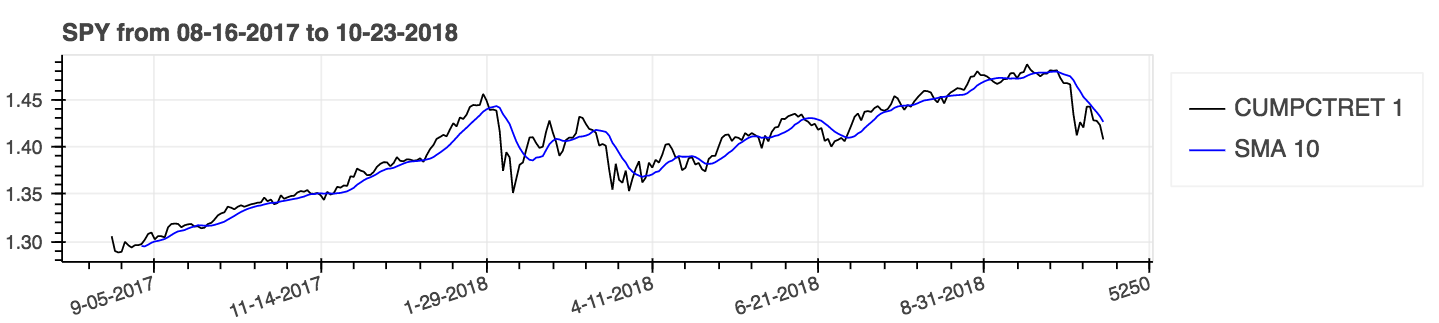

| 返回百分比(累積),簡單移動平均值(SMA) |

|---|

|

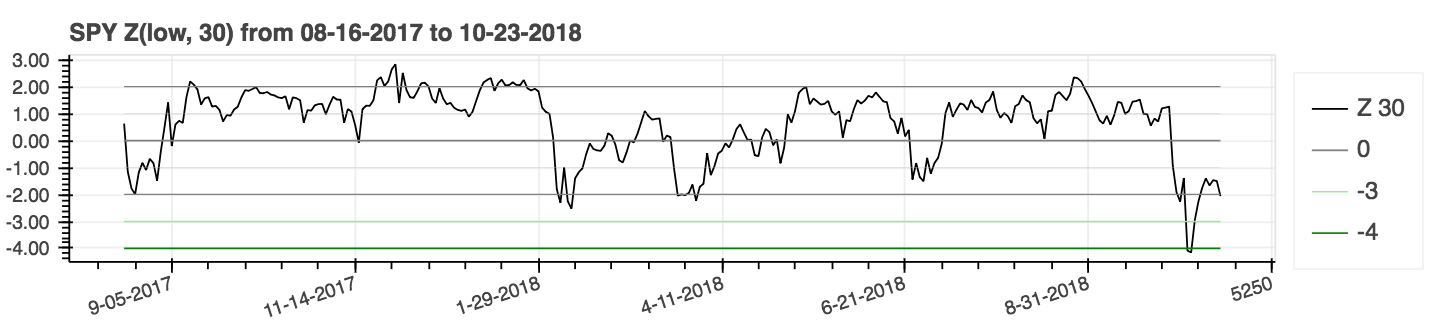

| Z得分 |

|---|

|

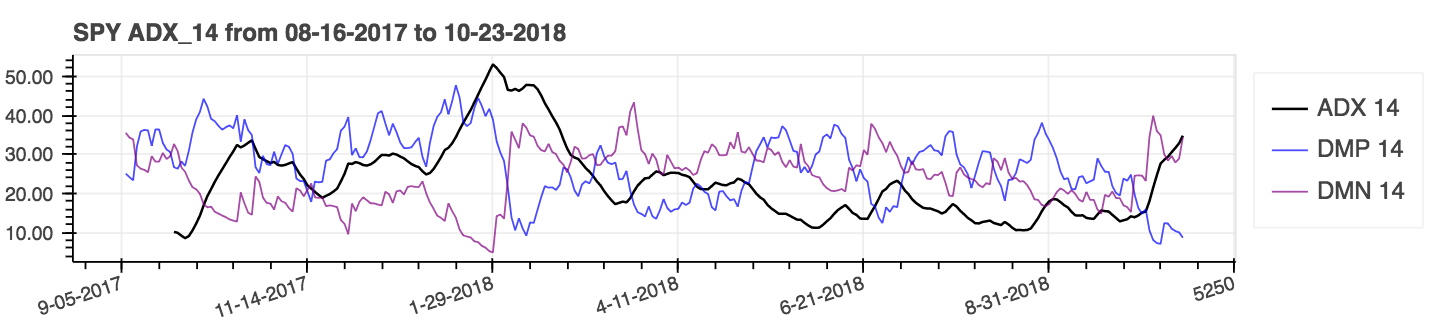

lookahead=False至“禁用中心”並刪除潛在的數據洩漏。| 平均方向運動指數(ADX) |

|---|

|

| 平均真實範圍(ATR) |

|---|

|

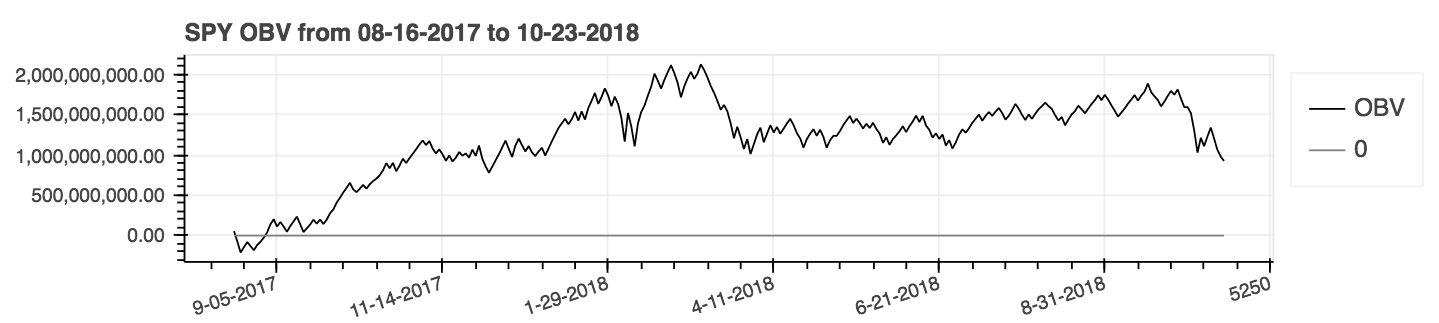

| 平衡體積(OBV) |

|---|

|

性能指標是該軟件包的新補充,因此可能是不可靠的。自行使用。這些指標返回浮點,不屬於數據框架擴展名。它們被稱為標準方式。例如:

import pandas_ta as ta

result = ta . cagr ( df . close )為了更輕鬆地與vectorbt的from_signals方法集成在一起,已用ta.trend_return方法已被ta.tsignals方法替換,以簡化交易信號的生成。有關全面的示例,請參見示例目錄中的pandas ta的示例jupyter筆記本電腦vectorbt回測。

import pandas as pd

import pandas_ta as ta

import vectorbt as vbt

df = pd . DataFrame (). ta . ticker ( "AAPL" ) # requires 'yfinance' installed

# Create the "Golden Cross"

df [ "GC" ] = df . ta . sma ( 50 , append = True ) > df . ta . sma ( 200 , append = True )

# Create boolean Signals(TS_Entries, TS_Exits) for vectorbt

golden = df . ta . tsignals ( df . GC , asbool = True , append = True )

# Sanity Check (Ensure data exists)

print ( df )

# Create the Signals Portfolio

pf = vbt . Portfolio . from_signals ( df . close , entries = golden . TS_Entries , exits = golden . TS_Exits , freq = "D" , init_cash = 100_000 , fees = 0.0025 , slippage = 0.0025 )

# Print Portfolio Stats and Return Stats

print ( pf . stats ())

print ( pf . returns_stats ())mamode kwarg ,並使用移動平均工具函數ta.ma()進行了更多移動的平均選擇。為簡單起見,所有選擇都是單源移動平均值。這主要是具有mamode Kwarg的指標使用的內部實用程序。這包括指標: ACCBAND , AMAT , AOBV , ATR , BBANDS , BANG , EFI , HILO , KC , NATR , QQE , RVI和THERMO ;默認的mamode參數尚未更改。但是,如果需要,用戶也可以使用ta.ma() 。有關更多信息: help(ta.ma)to_utc ,將數據框架索引轉換為UTC。請參閱: help(ta.to_utc)現在作為pandas ta dataframe屬性,可以輕鬆將數據框架索引轉換為UTC。 close > sma(close, 50)之類的趨勢系列時,它會返回該趨勢的趨勢,貿易參賽作品和貿易出口,以使其與VectorBT兼容,以使其與asbool=True兼容,以獲取Boolean Trade參賽作品和退出。請參閱help(ta.tsignals) help(ta.alma)交易帳戶或資金。請參閱help(ta.drawdown)help(ta.cdl_pattern)help(ta.cdl_z)help(ta.cti)help(ta.xsignals)help(ta.dm)help(ta.ebsw)help(ta.jma)help(ta.kvo)進行比較。help(ta.stc)help(ta.squeeze_pro)df.ta.strategy()中脫穎而出。請參閱help(ta.td_seq)help(ta.tos_stdevall)help(ta.vhf) mamode重命名為mode 。請參閱help(ta.accbands) 。mamode ,並且具有與TradingView相同的mamode選項。新參數lensig行為與TradingView的內置ADX指標一樣。請參閱help(ta.adx) 。drift參數和更多描述性列名。mamode現在是“ RMA ”,並且具有與TradingView相同的mamode選項。請參閱help(ta.atr) 。ddoff控制自由度。還包括BB百分比(BBP)作為最後一列。默認值為0。請參閱help(ta.bbands) 。ln新論點。默認值為false。請參閱help(ta.chop) 。True tvmode 。當tvmode=False時, CKSP實現了具有默認值的“新技術交易者”。請參閱help(ta.cksp) 。talib將使用TA Lib的版本,如果安裝了TA Lib。默認是正確的。請參閱help(ta.cmo) 。strict檢查該系列是否隨著更快的計算在周期length上不斷減小。默認值: False 。默認情況下也添加了percent參數。請參閱help(ta.decreasing) 。strict檢查該系列是否在更快的計算中不斷length 。默認值: False 。默認情況下也添加了percent參數。請參閱help(ta.increasing) 。help(ta.kvo) 。as_strided方法還是較新的sliding_window_view方法。這應該解決Google COLAB的問題,並延遲依賴性更新以及Tensorflow的依賴關係,如第285和#329期所討論的。asmode啟用了MACD版本。默認值為false。請參閱help(ta.macd) 。sar 。新參數af0初始化加速度因子。請參閱help(ta.psar) 。mamode作為選項。默認值是與Ta Lib匹配的SMA 。請參閱help(ta.ppo) 。13和信號MA模式mamode添加signal ,默認EMA作為參數。請參閱help(ta.tsi) 。help(ta.vp) 。help(ta.vwma) 。anchor的新參數。默認值:“每日”。有關其他選項,請參見時間表偏移別名。要求DataFrame索引為DateTimeIndex。請參閱help(ta.vwap) 。help(ta.vwma) 。Z_length更改為ZS_length 。請參閱help(ta.zscore) 。原始ta-lib | TradingView |塞拉圖表| mql5 | FM Labs | Pro真實代碼|用戶42

感覺很慷慨,就像包裝一樣,還是想看到它變得更加成熟?